colorado springs sales tax calculator

The statewide sales tax in Colorado is just 290 lowest among states with a sales tax. The base state sales tax rate in Colorado is 29.

Sales Taxes In The United States Wikiwand

Colorado state sales tax rate range 29-112 Base state sales tax rate 29 Local rate range 0-83 Total rate range 29-112 Due to varying local sales tax rates we strongly.

. Average Local State Sales Tax. Manufactured homes in Colorado but not other forms. Maximum Possible Sales Tax.

S Colorado State Sales Tax Rate 29 c County Sales Tax Rate l Local Sales Tax Rate sr Special Sales Tax Rate So whilst the Sales Tax Rate in Colorado is 29 you can actually pay anywhere between 29 and 10 depending on the local sales tax rate applied in the municipality. Colorado Springs CO Sales Tax Rate The current total local sales tax rate in Colorado Springs CO is 8200. Find your Colorado combined.

The minimum is 29. Some cities in Colorado are in process signing. Enter your Amount in the respected text field Choose the Sales Tax Rate from the drop-down list.

Sales Tax Rate s c l sr Where. Local tax rates in Colorado range from 0 to 83 making the sales tax range in Colorado 29 to 112. Download all Colorado sales tax rates by zip code The Colorado Springs Colorado sales tax is 290 the same as the Colorado state sales tax.

The calculator will show you the total sales tax. If your business purchased or consumed items with an invoice date of 12312020 and prior the use tax will be due at the. Visit the COVID-19 Sales Tax Relief web page for more information and filing instructions.

This site is now available for your review. Colorado Sales Tax Lookup. While Colorado law allows municipalities to.

You can print a 82. However as anyone who has spent time in Denver Boulder or. Ad Manage sales tax calculations and exemption compliance without leaving your ERP.

This is the total of state county and city sales tax. The minimum combined 2022 sales tax rate for Colorado Springs Colorado is. City sales tax collected within this date range will report at 312.

Welcome to the Sales and Use Tax Simplification SUTS Lookup Tool. S Colorado State Sales Tax Rate 29 c County Sales Tax Rate l Local Sales Tax Rate sr Special Sales Tax Rate You can calculate Sales Tax manually using the formula or use the. Colorado Sales Tax Calculator You can use our Colorado Sales Tax Calculator to look up sales tax rates in Colorado by address zip code.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. This information is intended to provide basic guidelines regarding the collection of sales and use tax ownership tax and license fees. Maximum Local Sales Tax.

This includes the rates on the state county city and special levels. What is the sales tax rate in Colorado Springs Colorado. Real property tax on median home.

The December 2020 total local sales tax rate was 8250. Motor vehicle dealerships should review the. Effective January 1 2021 the City of Colorado Springs sales and use tax rate has decreased from 312 to 307 for all transactions occurring on or after that date.

The GIS not only. Sales Tax Calculator Calculate Before Tax Amount 000 Sales Tax 000 Plus Tax Amount 000 Minus Tax Amount 000 Enter an amount into the calculator above to find out how what kind. How to Calculate Colorado Sales Tax on a Car To calculate the sales tax on your vehicle find the total sales tax fee for the city.

Sales Tax State Local Sales Tax on Food. How to use Colorado Springs Sales Tax Calculator. Avalara provides supported pre-built integration.

The Geographic Information System GIS now allows Colorado taxpayers to look up the specific sales tax rate for an individual address. Check your city tax. Sales tax in Colorado Springs Colorado is currently 825.

Ownership Tax Calculator Estimate ownership taxes. Rates are expressed in mills which are equal to 1 for every 1000 of property value. Multiply the vehicle price.

The 82 sales tax rate in Colorado Springs consists of 29 Colorado state sales tax 123 El Paso County sales tax 307 Colorado Springs tax and 1 Special tax. The sales tax rate for Colorado Springs was updated for the 2020 tax year this is the current sales tax rate we are using in the. The combined amount is.

724 Average Sales Tax Summary The average cumulative sales tax rate in Colorado Springs Colorado is 724. The Sales Tax Return DR 0100 changed for the 2020 tax year and subsequent periods. Colorado Sales Tax.

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

How To Ensure The Right Sales Tax Rate Is Applied To Each Transaction

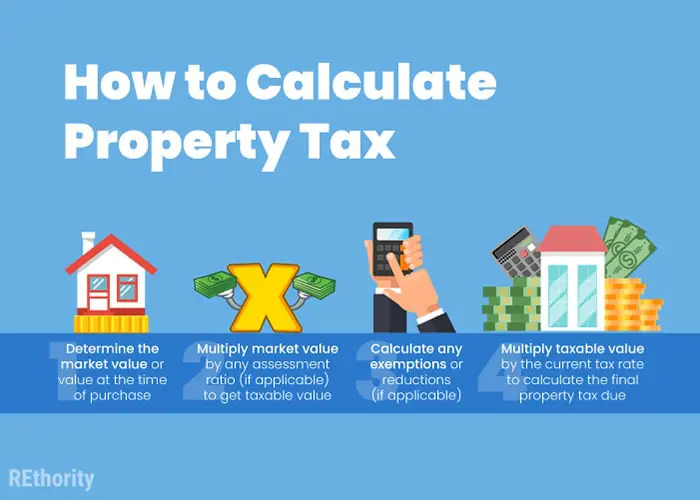

Property Tax Calculator Property Tax Guide Rethority

Colorado Vehicle Sales Tax Fees Calculator Find The Best Car Price

Colorado Vehicle Sales Tax Fees Calculator Find The Best Car Price

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

The Income Tax Rate In Colorado Is 4 63 This Is Not The Only Tax You Will Pay On Your Earnings

Property Tax Calculator Property Tax Guide Rethority

Colorado Sales Tax Rates By City County 2022

State By State Guide To Sales Tax At Craft Fairs And Festivals Taxjar

Sales Tax Information Colorado Springs

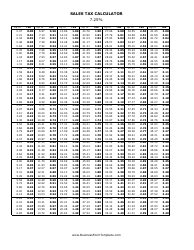

7 25 Sales Tax Calculator Download Printable Pdf Templateroller

How To Ensure The Right Sales Tax Rate Is Applied To Each Transaction

Sales Taxes In The United States Wikiwand

Property Tax Calculator Property Tax Guide Rethority

Wyoming Sales Tax Small Business Guide Truic

Property Tax Calculator Property Tax Guide Rethority

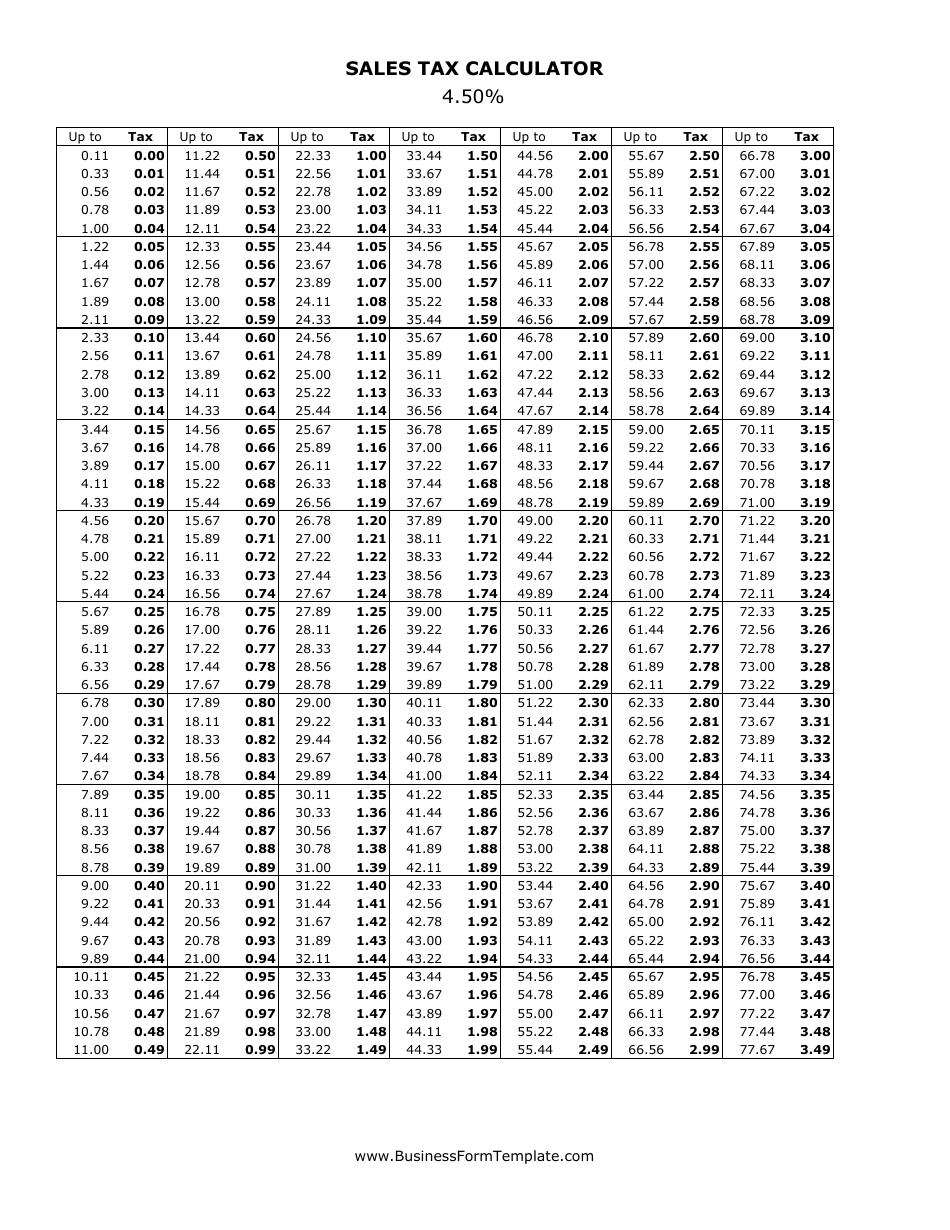

4 5 Sales Tax Calculator Download Printable Pdf Templateroller